How does your credit score affect your mortgage rate?

The Lawhead Team would like to share the latest One Cool Thing about your credit score and the type of mortgage rate available to you:

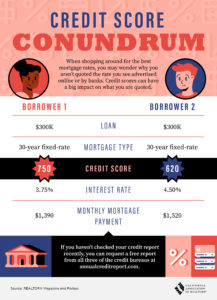

When shopping around for the best mortgage rates, you may wonder why you aren’t quoted the rate you see advertised online or by banks. Your credit score can have a big impact on what you are quoted.

When shopping around for the best mortgage rates, you may wonder why you aren’t quoted the rate you see advertised online or by banks. Your credit score can have a big impact on what you are quoted.

Scenario: Both borrowers are applying for a $300,000 loan with a 30-year fixed-rate mortgage.

Borrower 1 has a 750 credit score – their interest rate will be 3.75% with a monthly mortgage payment of $1,390

Borrower 2 has a 620 credit score – their interest rate will be 4.50% with a monthly mortgage payment of $1,520.

If you haven’t checked your credit report recently, you can request a free report from all three credit bureaus at www.annualcreditreport.com to see what your credit score is.

Source: REALTOR Magazine and Forbes